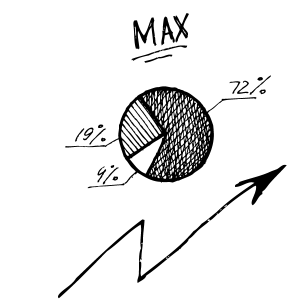

LL.M. programs in US Tax Law are in high demand among attorneys seeking specialized expertise. With income and payroll taxes contributing over $3 trillion annually to the US economy, the need for skilled tax lawyers is evident.

Taxation laws in the US have a profound impact globally, influencing various aspects of citizens' lives. For lawyers, particularly those practicing in the US or dealing with US tax laws internationally, pursuing an LL.M. in US Tax Law offers invaluable knowledge and practical experience.

Graduates of these programs are well-prepared to specialize in tax law within law firms, corporations, government agencies, and academia. This specialized expertise is beneficial not only in tax-related fields but also in areas such as family law, property, finance, energy, and healthcare, where tax policies can significantly influence legal matters.

For those interested in delving deeper into international tax law, exploring the top LL.M. programs in International Tax Law is recommended.

Discover the top 10 LL.M. programs in US Tax Law below and take the first step towards becoming a sought-after tax law specialist.

New York University’s LL.M. in Taxation is offered with a variety of concentrations: general taxation, business taxation, estate planning, tax policy and international taxation, which is available to US-trained attorneys. Other elective courses cover state and local taxation, executive compensation, bankruptcy, and civil and criminal tax procedure. Practicing lawyers are able to enroll on the program part-time, in order to keep up with work commitments. NYU additionally offers the Executive LL.M. in Taxation, which can be completed entirely online. NYU’s Law School is typically ranked at or near the top law school for tax by US News & World Report.

View School Profile

Georgetown University’s Master of Laws in Taxation provides the opportunity to study taxation law in Washington D.C., where the country’s laws are made and enforced. In fact, the university’s Law Center is located just two blocks from the US Tax Court, and close to many of the nation’s other legal institutions. Students can undertake externships at government agencies and nonprofits as well as legal and accounting firms. The Tax Center hosts regular panel discussions with taxation experts and government tax officials. This school is usually ranked near the top of the US News ranking of top law schools for taxation.

View School Profile

The University of Florida is usually ranked in the top-five of the best law schools for tax law in the US News ranking. The UF Law Graduate Tax Program is taught by renowned faculty members who have published important texts in the field of taxation. As well as the LL.M. in Taxation, focusing on tax from a U.S. perspective, the school also offers an LL.M. in International Taxation as well as an SJD in Taxation. The University of Florida is home to the Richard B. Stephens Tax Research Center, which produces leading research on taxation.

View School Profile

Northwestern’s high-ranking LL.M. in Taxation covers the four principal areas of taxation of property transactions, corporate taxation, partnership taxation, and international taxation, along with a variety of electives. With seven residential tax faculty professors and a dedicated career adviser, the 40 students admitted to Northwester's Tax Program every year enjoy an exceptionally high faculty-student ratio. Northwestern additionally offers a joint JD-LL.M. in Tax, where students have the possibility of completing both degrees in just six or seven semesters.

View School Profile

Call it a bit of historical irony: even though the University of Virginia School of Law was founded by the notoriously anti-tax Thomas Jefferson, it now offers one of the top LL.M. concentrations in Tax Law in the country, which is usually ranked in the top-five of the best law schools for tax law by US News & World Report. With an extensive array of tax-focused courses on offer, LL.M. students have the flexibility to construct a curriculum of broad-based or specialized instruction in the field, including tax policy, federal income tax, corporate tax, accounting, and estate planning. The school is home to a nonprofit law clinic where students gain practical experience, as well as the Virginia Tax Review journal.

View School Profile

Established in 1959, the Graduate Tax Program at Boston University School of Law is one of the nation’s oldest and highest-regarded such programs. The LL.M. in Taxation is designed for recent graduates as well as mid-career and seasoned attorneys, with flexibility built into the curriculum: The degree may be completed in person or online, full-time or part-time. Optional areas of specialization include estate planning, international taxation, and financial services taxation.

View School Profile

Loyola Law School in Los Angeles offers a rigorous graduate tax program with an application process that is more selective than the school’s JD . Students on the Tax LL.M. have the opportunity to gain practical experience at the school’s numerous law clinics that serve on small cases, taxpayer appeals, and non-profit cases, among others. Loyola also offers a joint JD/LL.M. in just three years, as well as a Master in Taxation for non-lawyers who wish to enhance their careers with the same tax law training available to law graduates in the LL.M. program. The Loyola Tax Policy Colloquium hosts tax scholars speaking on current tax law concepts and challenges. The school also offers an Online Tax LL.M.

View School Profile

Columbia Law School holds an annual Tax Policy Colloquium, which introduces students to current tax policy research via a number of renowned tax scholars who present throughout the semester. The school’s LL.M. is a general one, but it offers courses in taxation, property and real estate. Externships, pro bono projects, legal clinics and the school’s 14 law journals all provide experiential learning opportunities. LL.M. students are able to take courses from Columbia Business School and the School of International and Public Affairs, creating the possibility of an interdisciplinary study experience.

View School Profile

Students admitted to the Harvard LL.M. program can apply for a Concentration in Taxation. The concentration covers tax law finance and strategic planning, and then students have a choice of elective topics including tax policy, trusts and estates, corporate mergers, acquisitions and divisions and comparative tax law. The International Tax Program is available for visiting scholars from all over the world, both for research and to undertake the LL.M.

View School Profile

The University of San Diego School of Law’s LL.M. in Taxation turns out graduates with a deep understanding of US tax policy. Aside from gaining the knowledge of theory and practical skills to become practicing tax lawyers, students explore tax policymaking, policy reform and the Internal Revenue Service. The school offers JD degree students the opportunity to earn the LL.M. in taxation in just one additional semester.

View School ProfileMore Schools

Related LLM News

Related Articles

Ethnically Diverse LL.M. Programs in the U.S.

Jun 25, 2024

Ethnic diversity, like all forms, is a vital aspect of any degree program, especially in the field of law. As the world becomes increasingly globalized, the legal profession is evolving to reflect and understand a wide range of perspectives and experiences.

Preparing for an LL.M. Admissions Interview

Jun 21, 2024

This guide aims to provide you with a roadmap on how to prepare effectively for an LL.M. interview, ensuring you make a lasting impression on the admissions committee.

LL.M. Application Essentials: How to Write a Competitive CV

May 02, 2024

Your CV or resumé is your ticket to an LL.M. program. Learn how to make it shine.

Wanted for LL.M. Programs: Tax Nerds

Mar 10, 2016

The best way to get into that selective US Tax LL.M. you have your eye on? Enthusiasm