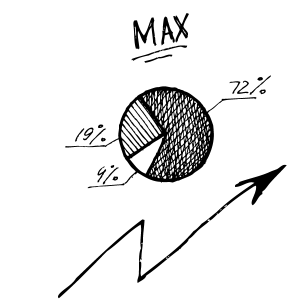

It’s boom time for new financial services. The value of the world’s cryptocurrencies passed a record $2.4 trillion in 2021 and the volume of non-fungible tokens (NFTs) reached more than $2.5 billion. For example, the sale of an NFT representing a digital work by artist Beeple for $69.3 million at Christie’s made headlines last March.

But what people seldom see is the army of legal professionals toiling in relative obscurity to make these services possible. Lawyers are wrestling with new financial concepts set against old legal frameworks. And they are operating in legal grey areas where regulators are still writing the rules. So, there is an opportunity for law schools to provide guidance.

Some LL.M. programs are responding to the growth of fintech with new courses. It’s a vast and growing area, ranging from online banking and new payment solutions to artificial intelligence and cryptocurrencies. In addition to incorporating some of these topics into traditional modules on banking and financial law, some pioneering law schools have started to offer dedicated modules on fintech.

For example, the Dickson Poon School of Law, at King’s College London, has been running a module on fintech for several years now. Another LL.M. module specializes in cryptocurrencies and blockchains, combining the expertise of the law school with King’s computer science department.

Michael Schillig, professor of law at the school, says: “Law schools have an important responsibility to educate our students and provide them with the skills necessary to cope with a fast-evolving technological landscape.”

He says that law schools must move more towards a different mindset if they are to produce lawyers with the skillset needed for the years to come. “We must address the concrete policy issues emanating from innovation, with a view to harnessing its possibilities and minimizing its dangers,” says Schillig. “And utilize technology to advance regulatory and normative goals.”

Are there post-LL.M. career opportunities in fintech?

According to some law school administrators, there is an emerging need for lawyers in the fintech space. For LL.M. graduates, these career opportunities promise to be varied. A vast number of start-ups operate in this space, Schillig says. “They provide exciting opportunities for lawyers who want to work at the very cutting edge of fintech. And who knows, if a start-up goes public, this can be very lucrative.”

Lee Reiners, executive director of Duke Law’s Global Financial Markets Center, says: “There are companies that are desperate for solid legal advice, especially in a rapidly changing regulatory landscape, so that presents tremendous opportunities.

“A lot of law firm clients are companies that are founded by people who have a tech background or haven’t operated in financial services before, and are frankly taken aback when they discover just how heavily regulated it is.”

He sees fintech as an extension of financial regulation, and he builds on these foundations in his teaching at Duke Law. At the Global Financial Markets Center, he teaches a law and policy class for LL.M. students, which has become a full three-credit-course that meets twice a week for an hour and a half every fall.

A rapidly changing fintech landscape

But with the fintech sector is rapidly changing, it can be challenging to keep up with current developments in LL.M. classes. “The rules are being written as we speak,” says Reiners. “There’s really no point in me preparing slides more than a week in advance, because within that week something could’ve happened — a new rule, a new court decision, a new private launch.”

Once, some academics and lawyers viewed the cryptocurrency space with skepticism, “perhaps as a passing fad”, says Tony Lai, an LL.M. candidate at Stanford’s Law School in California who founded the Stanford Journal of Blockchain Law & Policy. “But the overwhelming feedback we have received is that blockchain has enabled many legal and policy professionals to contribute to and benefit from a supportive ecosystem,” says Lai.

Stanford Law School benefits from the broader ecosystem at Stanford University, including the computer science department. At CodeX, the Stanford Center for Legal Informatics, LL.M. students work with entrepreneurs and technologists to advance the frontier of legal technology and computational law, including financial technologies.

Many law schools are setting up similar initiatives. “We are adapting our courses,” says Linda Jeng, a visiting scholar on financial technology at Georgetown University Law Center in Washington, D.C. “For example, we teach how international financial regulation is evolving in light of financial technologies and examining how laws and regulations can be applied to new technologies.”

What advice would fintech scholars give to someone who wants to go into the sector? “Stay on top of industry developments because the legal needs flow from the business strategy and the business strategy is always changing,” says Reiners at Duke Law.

“And you don’t have to be a coder by any stretch, but to the extent that you have some familiarity with these technologies, whether it be a cryptocurrency wallet, Venmo, or some of these other innovations, if you can use them and get hands-on experience, that also helps.”